This is possibly a little pre-emptive, however I would like to take a break from the market volatility, and try to move your focus forward 6-12 months from now.

The news cycle is doing what we expect at the moment and every five minutes there is a Minister, Premier or ‘expert’ giving their view on what will or won’t happen. Remember they want you to ‘tune into the next episode’ so the language will always be dire and urgent.

The saying ‘Nature abhors a vacuum’ very aptly describes the situation we are in at the moment. We don’t like uncertainty and when there is no new information, someone will try to fill the void with ‘their’ take on the unknown.

As usual, ‘unprecedented’ is getting a great run. The only unprecedented part of the Coronavirus is the impact social media is having on the speed of information. Even toilet roll hysteria is not unprecedented – who could forget ‘The Great Toilet Paper Scare of 1973’ – yes it was a thing, google it

We have had pandemics before, as recently as 2009 but remember:

- The first Apple smart phone was brought to market in 2007 and Facebook (a university site in 2004) really only started to get traction in 2008. 2010 was when it really scaled up;

- Instagram only launched in 2010;

- Youtube started in 2005 but without smart phones only escalated in 2009/10.

So now the vast majority of us carry a world wide access medium all the time! Can I suggest the best place to get information is via the government website https://www.health.gov.au/news/health-alerts/novel-coronavirus-2019-ncov-health-alert – it is updated every day.

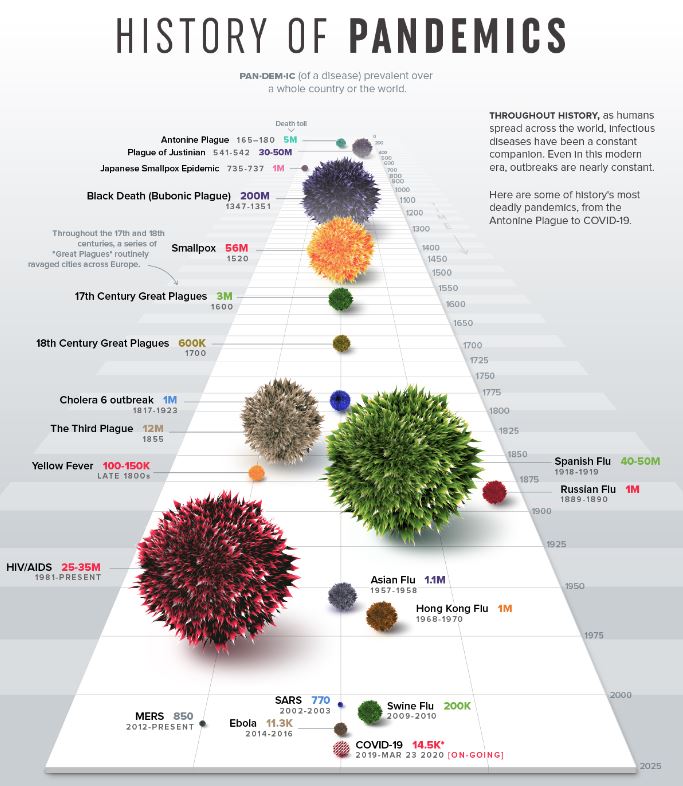

The below infographic is a great summary of the history of pandemics. The worst being:

- The Bubonic Plague (1347 – 1351) killed over 200 million people and yes, medical resources and antibiotics have improved a little since then!

Where are we today?

We have a long history of pandemics and our little island nation has one of the best and most accessible health systems in the world.

At the time of writing, being 3.00pm, 24 March, more than 160,000 Australians have been tested and there are 2,044 identified cases.

- We have had eight deaths.

In the Western Pacific region, we have had 96,579 identified cases but China has had 81,171 of those and South Korea 9,037 which gives a combined total of 90,208. The remaining number of cases across our region is at 6,371.

- The most impacted countries after China, are Italy (63,927 cases) and the US (46,450 cases).

There is a big difference between cases identified and actual deaths and now doctors know what they are dealing with, the treatment is improving.

As well as the human tragedy, all of these pandemics impacted supply chains and the economies they occurred in.

Most ran for a number of years before they were brought back under control.

Where will be in 6-12 months’ time? (I know we shouldn’t crystal ball but I am pretty comfortable in the below)

We will have had a lot more cases identified and tragically a lot more deaths.

We will most probably have a vaccine. The US is starting human testing as I write this: https://www.dw.com/en/us-researchers-start-human-trials-for-coronavirus-vaccine/a-52801697. It may not be available in the quantities needed but we will know it exists.

The World Health Organization is working with scientists across the globe on at least 20 different coronavirus vaccines with some already in clinical trials in record time — just 60 days after sequencing the gene. “The acceleration of this process is truly dramatic in terms of what we’re able to do, building on work that started with SARS, that started with MERS and now is being used for COVID-19,” Dr. Maria Van Kerkhove, the technical lead for WHO’s emergencies program, said at a press conference at the organization’s headquarters in Geneva.

We probably also have a cure https://www.news.com.au/lifestyle/health/health-problems/coronavirus-australia-queensland-researchers-find-cure-want-drug-trial/news-story/93e7656da0cff4fc4d2c5e51706accb5. The cure will not stop the spread of the virus but cases that are diagnosed will have a medical solution. The solution described here may not work but you can assume someone will create an answer.

Earnings for a whole range of companies and businesses will have been badly hurt. Profits will be down and for companies/businesses with thin margins and high debt, it may mean they have collapsed.

- Governments around the world will have poured money into the system to prop up essential services and the industries most impacted. They want consumers to spend so there will be ‘helicopter’ money;

- Companies and businesses with good balance sheets will already be recovering as consumers regain confidence that the world will be okay;

- Share markets will recover (maybe sooner as markets react to future earnings) because of these companies but also because of the realisation that this was a temporary issue, not a structural issue;

- China and the US will be arguing about trade again;

- Disappointed extremists will bemoan the survival of capitalism;

- Fuel prices will be up;

- Apple will probably have a new phone; and

- The Europeans will still dislike the British.

This next three to six months is going to be very challenging but we will get through it.

We will all do our bit to reduce the spread of the virus and while the new normal is video conferencing, no international travel, very clean hands and fist pumps rather than handshakes, this too shall pass.

As always we are here to help and yes we are working very hard to get the best result we can for you.

If you have concerns at all please do not hesitate to contact us. Likewaise, if you have a friend or family mamber that requires advice, or would simply like a review of their financial situation, please call our office to arrange an appointment on (07) 5574 0667.

We encourage all of our clients and colleagues to Like and Follow us on Facebook as we will be posting exclusive content including business updates throughout 2020.

This communication is general advice only and does not consider your personal circumstances. You should not act on any information without obtaining professional financial advice specific to your circumstances. This communication including any attachments is intended solely for the use of the individual to whom it is addressed. Any unauthorised use, dissemination, forwarding, printing, or copying of this communication including any attachments is prohibited. It is your responsibility to scan this communication including any file attachment for viruses and other defects. To the extent permitted by law, we will not be liable for any loss or damage arising in any way from this communication including file attachments.