As evidenced by the current situation globally, financial markets can be subject to periods of event-related volatility during which investor confidence can be significantly undermined. Here, we provide a number of key messages to help our clients continue to navigate through these volatile times.

- Volatility is a normal part of long-term investing

From time to time, there is inevitably volatility in stock markets as investors react nervously to changes in the economic, political and corporate environment. Above all else, financial markets dislike uncertainty. Yet markets are also prone to over-react to events that cloud the short-term outlook. As an investor, it is important to take a step back at these times and keep an open mind.

When we are prepared at the outset for episodes of volatility on the investing journey, we are less likely to be surprised when they happen, and more likely to react rationally. By having an open mind and a longer-term investment perspective that accepts short-term volatility, investors can begin to take a more dispassionate view. Not only does this help with the job of staying focused on long-term investment goals, it also allows investors to begin to appreciate the opportunity lower prices present rather than lock in losses by emotionally selling at the wrong time.

- Over the long term, equity risk is usually rewarded

Equity investors are typically rewarded for the extra risk they face – compared to, for example, sovereign bond investors – with higher average returns over the longer term. It is also important to remember that risk is not the same as volatility. Asset prices regularly deviate from their intrinsic value as markets overshoot or undershoot, so investors can expect price volatility to create opportunities. In the long term, stock prices are driven by corporate earnings and have generally outperformed other types of investment in real terms, that is, after inflation.

- Market corrections can create attractive opportunities

Corrections are a normal feature of stock markets; it is normal to see more than one over the course of a bull market. A stock market correction can be a good time to invest in equities as valuations become more attractive, giving investors the potential to generate above-average returns when the market rebounds. Some of the worst historical short-term stock market losses were followed by significant rebounds.

- Avoid ‘stopping’ and ‘starting’ investments

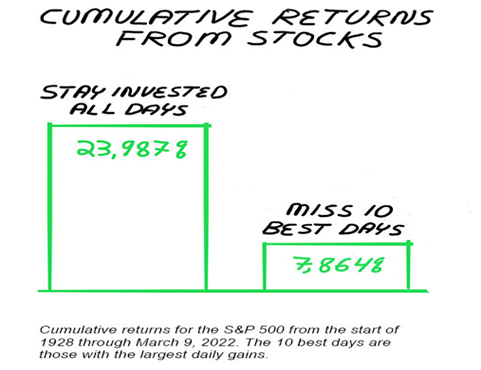

Those who remain invested typically benefit from the long-term uptrend in stock markets. When investors try to time the market and stop-and-start their investments, they can run the risk of denting future returns by missing the best recovery days in the market and the most attractive buying opportunities that become available during periods of pessimism. Missing out on just five of the best performance days in the market can have a significant impact on longer-term returns. This is reflected in the following image:

If you stayed invested in the S&P 500 from the start of 1928 through March 9, 2022, you would have earned 23,987.2%. If you were out of the market for the 10 worst days over that period, you would have seen your return increase to 26,525.8%. Perhaps most surprising, though, was the impact of missing out on the 10 best days. Sitting on the sidelines for 0.04% of the days over this period would have dropped your return to 7,864.5%.

- The benefits of regular investing stack up

Irrespective of an investor’s time horizon, it makes sense to regularly invest a certain amount of money in a fund, for example each month or quarter. This approach is known as dollar cost averaging. While it doesn’t promise a profit or protect against a market downturn, it can help lower the average cost of fund purchases. And although regular saving during a falling market may seem counter-intuitive to investors looking to limit their losses, it is precisely at this time when some of the best investments can be made, because asset prices are lower and will benefit from any market rebound. (Investors should always review their portfolio from time to time and adjust it if needed.)

- Diversification of investments helps to smooth returns

Asset allocation can be difficult to perfect as market cycles can be short and subject to bouts of volatility. During volatile markets, performance leadership can rotate quickly from one sector or market to another. Our portfolios spread the risk associated with specific markets or sectors by investing into different asset classes, using a mix of quality fund managers to reduce the likelihood of concentrated losses. We build portfolios that hold a mix of ‘growth’ assets (Australian equities, International equities, real estate) and defensive assets (fixed interest, bonds, and cash) which can help to smooth returns over time.

Investing in actively managed multi-asset funds within our portfolios provides additional asset level and geographic portfolio diversification. These funds are typically constructed on the basis of strategic long-term asset returns, with asset weights managed tactically according to expected conditions. Spreading investments over different countries can also help to bring down correlations within a portfolio and reduce the impact of market-specific risk.

- Don’t be swayed by sweeping sentiment

The popularity of investment themes ebbs and flows – for instance, technology has come full circle. This sector experienced a late 90s boom followed by a 2000s bust. More recently the sector again experienced a significant increase during the last 5 years followed by a significant pull back during the first 6 months of this year. Overall sentiment to emerging markets tends to wax and wane with the commodity cycle and as economic growth slows in key economies like China.

During such ebbs and flows, it’s important to remember that we have a plan, and investing, whether inside or outside of superannuation is a long term strategy. Like any good plan, it’s important to review it regularly, stay the course and remember the end goals we’re working towards.

It is wise to work through your options with a financial planner who can help you explore ways to make the most of every area of your finances.If you have any questions, require financial advice, or would simply like a review of your financial situation, please call our office to arrange an appointment on (07) 5574 0667.

We encourage all of our clients and colleagues to Like and Follow us on Facebook as we will be posting exclusive content including business updates throughout 2022.